Resideo to Acquire Snap One to Expand Presence in Smart Living Products and Distribution

SCOTTSDALE, Ariz. and CHARLOTTE, N.C.

- Creates strong position in security, audio visual, and smart living technology distribution for residential and commercial markets

- Highly complementary capabilities offer professional integrators an expanded selection of proprietary products, extensive third-party supplier relationships, and proven omni-channel reach

- Enhances Resideo’s growth and margin profile and accretive to non-GAAP EPS in first full year of ownership

- Identified expected annual run-rate business and financial synergies of $75 million by year three

- $500 million perpetual convertible preferred equity investment from CD&R

Resideo Technologies, Inc. (NYSE: REZI), a leading manufacturer and distributor of technology-driven products and solutions, and Snap One Holdings Corp. (Nasdaq: SNPO), a leading provider of smart-living products, services, and software to professional integrators, today announced a definitive agreement pursuant to which Resideo has agreed to acquire Snap One for $10.75 per share in cash, for a transaction value of approximately $1.4 billion, inclusive of net debt. Upon closing, Snap One will integrate into Resideo’s ADI Global Distribution business.

The transaction will combine ADI’s strong position in security products distribution and Snap One’s complementary capabilities in the smart living market and innovative Control4 technology platforms, which is expected to drive increased value for integrators and financial returns. Together, ADI and Snap One will provide integrators an increased selection of both third-party products and proprietary offerings through an extensive physical branch footprint augmented by industry leading digital capabilities.

“The acquisition of Snap One is an exciting step in Resideo’s continued transformation through portfolio optimization, operational enhancements and structural cost savings actions,” commented Jay Geldmacher, Resideo’s President and Chief Executive Officer. “ADI and Snap One are highly complementary businesses and together will meaningfully enhance our strategic and operational capabilities as a significant player in attractive growth categories. We are excited about the enhanced value proposition through increased product breadth, local availability, support services and broad market expertise, as well as the future opportunities this creates for integrators serving residential and commercial markets. In addition, the investment by Clayton, Dubilier & Rice is a testament to the strategic and financial merits of this transaction and provides financial flexibility as we continue to transform and optimize our portfolio. We look forward to the ADI and Snap One teams working together to drive value for all stakeholders through executing on the substantial business and financial synergies we see in combining the two businesses.”

“Snap One has grown from a startup built by entrepreneurial integrators to an industry leader in smart technology, delivering seamless experiences to consumers and high-quality services and support to our integrators,” said John Heyman, Chief Executive Officer of Snap One. “This is the right next step to capture new opportunities to bring our solutions to market. The future of smart living is here. Demand for connected technology products continues to grow, and Resideo is the right owner to drive our expansion. We believe this transaction will deliver compelling value to our stakeholders and will create opportunities for our people and integrator partners.”

“We are excited to support Resideo on this highly strategic acquisition and in their ongoing transformation,” commented Nathan Sleeper, CD&R’s Chief Executive Officer. “I look forward to joining Resideo’s Board of Directors and supporting the business as it executes on this transaction and the significant opportunity we see available over the coming years.”

Benefits of the Transaction

A Strong Position Across Multiple Attractive Categories: The acquisition will combine Snap One’s capabilities for smart living integrators with ADI’s complementary position in adjacent security products distribution. This cross-category expansion will allow the combined organization to materially deepen relationships with integrators to better serve their customers and expand their businesses.

Expansion of Proprietary Offering: The combination is expected to meaningfully accelerate ADI’s existing exclusive brands strategy, leveraging Snap One’s award-winning proprietary product portfolio and product development expertise while providing broader availability through ADI’s network of commercial and residential integrators and omni-channel capabilities. The combined company intends to leverage increased opportunities around innovation to drive value for integrators through a pipeline for proprietary products. Snap One generated 66% of sales from proprietary products in 2023 and these offerings typically carry significantly higher gross margin than third-party products.

Enhanced Integrator Value Proposition: ADI’s and Snap One’s professional integrators will benefit from significant synergy on go-to-market with Snap One’s e-commerce expertise and integrator support platforms and ADI’s 195 stocking locations and extensive digital capabilities. The combination is expected to create a true omni-channel experience for integrators, simplifying the buying experience and enhancing product availability. Additional opportunity exists to enhance value within the Control4 integrator base through increasing service levels, rapid product fulfilment and expanding exclusive offerings.

Attractive Financial Profile: The transaction is expected to be accretive to Resideo non-GAAP EPS in the first full year of ownership, with favorable revenue growth and margin profile to ADI and Resideo as a whole. Transaction financing has been structured to allow Resideo to preserve financial flexibility for future strategic initiatives.

Transaction Details

The transaction is valued at approximately $1.4 billion, including forecasted net debt of Snap One at the closing of approximately $460 million. This represents a 7.4x multiple on Snap One’s Adjusted EBITDA for the twelve months ended December 29, 2023, as further adjusted by including Resideo’s projected annual run-rate synergies of $75 million.

The transaction is expected to be completed in the second half of 2024, and is subject to customary closing conditions, including receipt of applicable antitrust and other regulatory approvals. The transaction has been unanimously approved by the Boards of Directors of Resideo and Snap One. Private investment funds managed by Hellman & Friedman LLC, holding approximately 72% of the outstanding common shares of Snap One, have executed a written consent to approve the merger, thereby providing the required stockholder approval for the transaction.

Resideo intends to use proceeds from committed debt financing, cash on hand, and a $500 million perpetual convertible preferred equity investment from Clayton, Dubilier & Rice LLC (“CD&R”) to fund the transaction. Terms of the CD&R investment include a 7% coupon, payable in cash or payment-in-kind at Resideo’s option, and a conversion price of $26.92. CD&R brings a long track record of value creation through its investments and significant experience in the specialty distribution market. Effective upon the closing, CD&R will have the right to designate two members to the Board of Directors of Resideo.

Transaction Conference Call Information

Resideo will host a conference call at 8:00 a.m. Eastern Time on April 15, 2024, to discuss the transaction. Interested parties may join the call via https://investor.resideo.com/, where related materials will be posted before the call, or by phone at 646-968-2525 or 888-596-4144 with the conference ID: 7959274. A replay of the webcast will be available at https://investor.resideo.com/.

Resideo Preliminary First Quarter 2024 Financial Results

For the first quarter ended March 30, 2024, Resideo’s preliminary expectations are for revenue of approximately $1,485 million, compared with outlook of $1,460 million to $1,510 million and Adjusted EBITDA above the midpoint of outlook of $120 million to $140 million provided in the fourth quarter and full-year 2023 results press release dated February 13, 2024. Resideo intends to release first quarter 2024 financial results after the close of the New York Stock Exchange on Thursday, May 2, 2024, and host a webcasted conference call at 5 p.m. ET.

Advisors

Evercore and Raymond James & Associates, Inc. are acting as financial advisors and Willkie Farr & Gallagher LLP is acting as legal counsel to Resideo. Bank of America and Morgan Stanley have provided committed financing for the transaction and are also acting as advisors to Resideo. Moelis & Company LLC and J.P. Morgan Securities LLC are serving as financial advisors to Snap One and have each provided a fairness opinion to Snap One’s board of directors. Simpson Thacher & Bartlett LLP is serving as Snap One’s legal counsel.

About Resideo

Resideo is a leading global manufacturer and developer of technology-driven products and components that provide critical comfort, energy management, and safety and security solutions to over 150 million homes globally. Through our ADI Global Distribution business, we are also a leading wholesale distributor of professionally installed electronic security and life safety products for commercial and residential markets and serve a variety of adjacent product categories including audio visual, data communications, and smart home solutions. For more information about Resideo, please visit www.resideo.com.

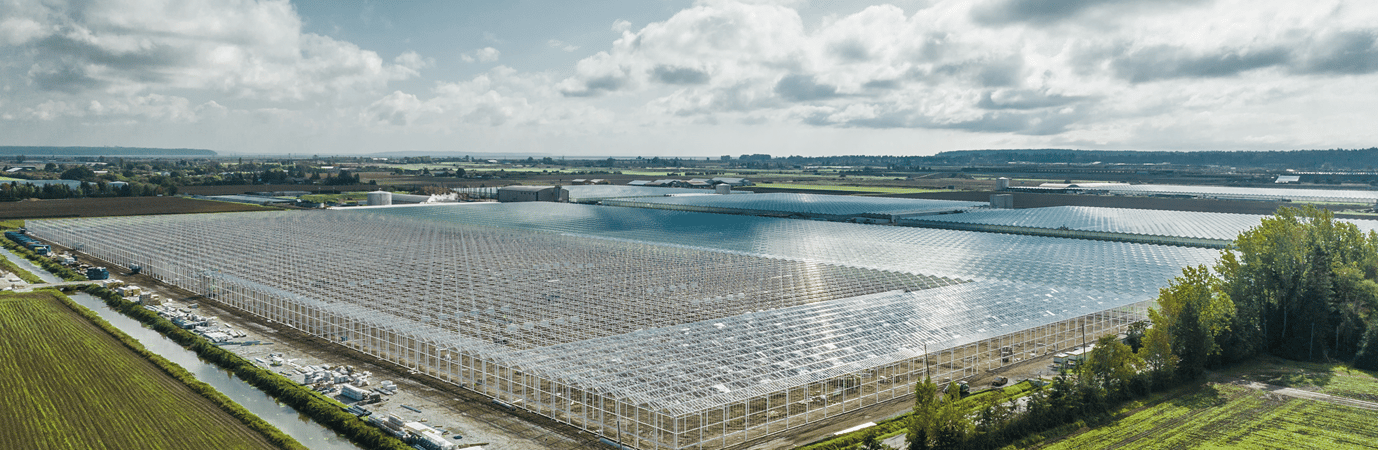

About Snap One

As a leading distributor of smart-living technology, Snap One empowers its vast network of professional integrators to deliver entertainment, connectivity, automation, and security solutions to residential and commercial end users worldwide. Snap One distributes an expansive portfolio of proprietary and third-party products through its intuitive online portal and local branch network, blending the benefits of e-commerce with the convenience of same-day pickup. The Company provides software, award-winning support, and digital workflow tools to help its integrator partners build thriving and profitable businesses. Additional information about Snap One can be found at www.snapone.com.

About Clayton, Dubilier & Rice

Founded in 1978, CD&R is a leading private investment firm with a strategy of generating strong investment returns by building more robust and sustainable businesses through the combination of skilled investment experience and deep operating capabilities. In partnership with the management teams of its portfolio companies, CD&R takes a long-term view of value creation and emphasizes positive stewardship and impact. The firm invests in businesses that span a broad range of industries, including industrial, healthcare, consumer, technology and financial services end markets. CD&R is privately owned by its partners and has offices in New York and London. For more information, please visit www.cdr-inc.com and follow the firm’s activities through LinkedIn and @CDRBuilds on X/Twitter.

Residio Investors:

Jason Willey

Jason Willey

Residio Vice President, Investor Relations

investorrelations@resideo.com

Adrienne Zimoulis

Residio Sr. Director of Communications

adrienne.zimoulis@resideo.com

Snap One:

Ashley Swenson

Senior Vice President, Marketing

ashley.swenson@snapone.com

Dana Gorman / Dan Scorpio

H/Advisors Abernathy

dana.gorman@h-advisors.global / dan.scorpio@h-advisors.global

Clayton, Dubilier & Rice Media:

Jon Selib

Jon Selib

Clayton, Dubilier & Rice Media

jselib@cdr-inc.com

Use of Non-GAAP Financial Measures

This press release includes certain “non-GAAP financial measures” as defined under the Securities Exchange Act of 1934. Resideo management believes the use of such non-GAAP financial measure, specifically Adjusted EBITDA, assists investors in understanding the ongoing operating performance of Resideo by presenting the financial results between periods on a more comparable basis. Non-GAAP Adjusted EBITDA should not be considered in isolation or as an alternative to results determined in accordance with U.S. GAAP. Resideo defines non-GAAP Adjusted EBITDA as Net Income as determined in accordance with U.S. GAAP, adjusted for the following items: provision for income taxes; depreciation and amortization expenses; interest expense, net; stock-based compensation expense; Honeywell reimbursement agreement non-cash expense; restructuring and impairment expenses; loss on the sale of assets, net, and foreign exchange transaction loss (income).

Resideo is unable to provide preliminary results for the comparable U.S. GAAP measure of Adjusted EBITDA for the first quarter 2024 without unreasonable efforts because the closing procedures for the first quarter of 2024 are not yet complete. Accordingly, Resideo is unable to provide a reconciliation from U.S. GAAP to non-GAAP Adjusted EBITDA without unreasonable effort. It is important to note that the amounts adjusted to the comparable U.S. GAAP measure may be material to Resideo’s first quarter 2024 reported results determined in accordance with U.S. GAAP.

This press release also includes a reference to Snap One’s Adjusted EBITDA, which is a non-GAAP financial measure. Snap One’s management believes that this non-GAAP financial measure provides useful information about the proposed transaction; however, it should not be considered as an alternative to U.S. GAAP net income (loss). A reconciliation between Snap One’s Adjusted EBITDA and U.S. GAAP net income (loss) for the annual period ended December 29, 2023, is provided in Snap One’s Annual Report filed with the SEC on Form 10-K on March 9, 2024.

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the federal securities laws. All statements, other than statements of fact, that address activities, events or developments that we or our management intend, expect, project, believe or anticipate will or may occur in the future are forward-looking statements. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results or performance of each company to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, (1) the ability of the conditions to the closing of the Snap One transaction being timely satisfied and the consummation of the transaction, (2) the ability of Snap One and/or Resideo to drive increased customer value and financial returns and enhance strategic and operational capabilities, (3) the ability of Snap One and/or Resideo to achieve the targeted amount of synergies and the related valuation implications described in this press release, (4) the accretive nature of the transaction to Resideo’s non-GAAP EPS in the first full year of ownership and the growth and margin profile of the combined businesses, (5) the ability to accelerate brand strategy as a result of the transaction, (6) the ability to integrate the Snap One business into Resideo and realize the anticipated strategic benefits of the transaction, including the anticipated operational and strategic benefits of the transaction, (7) actual Resideo results for the first quarter ended March 30, 2024 differing from the estimated financial results included in this press release, including due to the completion of our financial closing procedures, final adjustments and other developments that may arise between the date of this press release and the time that financial results for the first quarter of 2024 are finalized, (8) our expectation that the financing for the transaction will allow Resideo to maintain our existing credit ratings and preserve financial flexibility for future strategic initiatives, (9) the ability to recognize the expected savings from, and the timing and impact of, existing and anticipated cost reduction actions (10) the likelihood of continued success of our transformation programs and initiatives, and (11) the other risks described under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” in Resideo’s Annual Report on Form 10-K for the year ended December 31, 2023 and the other risks described under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” in Snap One’s Annual Report on Form 10-K for the fiscal year ended December 29, 2023 and such other periodic filings as each of Resideo and Snap One make from time to time with the Securities and Exchange Commission (SEC). You are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements are not guarantees of future performance, and actual results, developments, and business decisions may differ from those envisaged by our forward-looking statements. Except as required by law, we undertake no obligation to update such statements to reflect events or circumstances arising after the date of this press release, and we caution investors not to place undue reliance on any such forward-looking statements

View original content: https://www.prnewswire.com/news-releases/resideo-to-acquire-snap-one-to-expand-presence-in-smart-living-products-and-distribution-302116276.html

SOURCE Resideo Technologies, Inc.