- Investment to accelerate Milacron’s growth and strengthen its position as a global leader in highly engineered plastic processing solutions.

- Milacron’s comprehensive suite of equipment offerings and services enables the production of everyday products used across the construction, automotive, packaging, consumer goods, and medical sectors.

- Hillenbrand (NYSE: HI), Milacron’s current owner, will continue to remain a significant investor in the business.

BOSTON, Mass. and BATESVILLE, Ind. – February 5, 2025 – Bain Capital, a leading private investment firm, today announced a majority investment in the Milacron Injection Molding and Extrusion business (or the “Company”), a globally renowned provider of highly engineered plastic processing equipment and services. Bain Capital will partner with Milacron’s current owner, Hillenbrand, Inc. (NYSE: HI), who will remain a significant investor in the business to accelerate the Company’s continued growth. Bain Capital entered into a definitive agreement to purchase an ownership stake of approximately 51% of Milacron for $287 million, subject to customary closing adjustments. Hillenbrand will retain an ownership stake of approximately 49%.

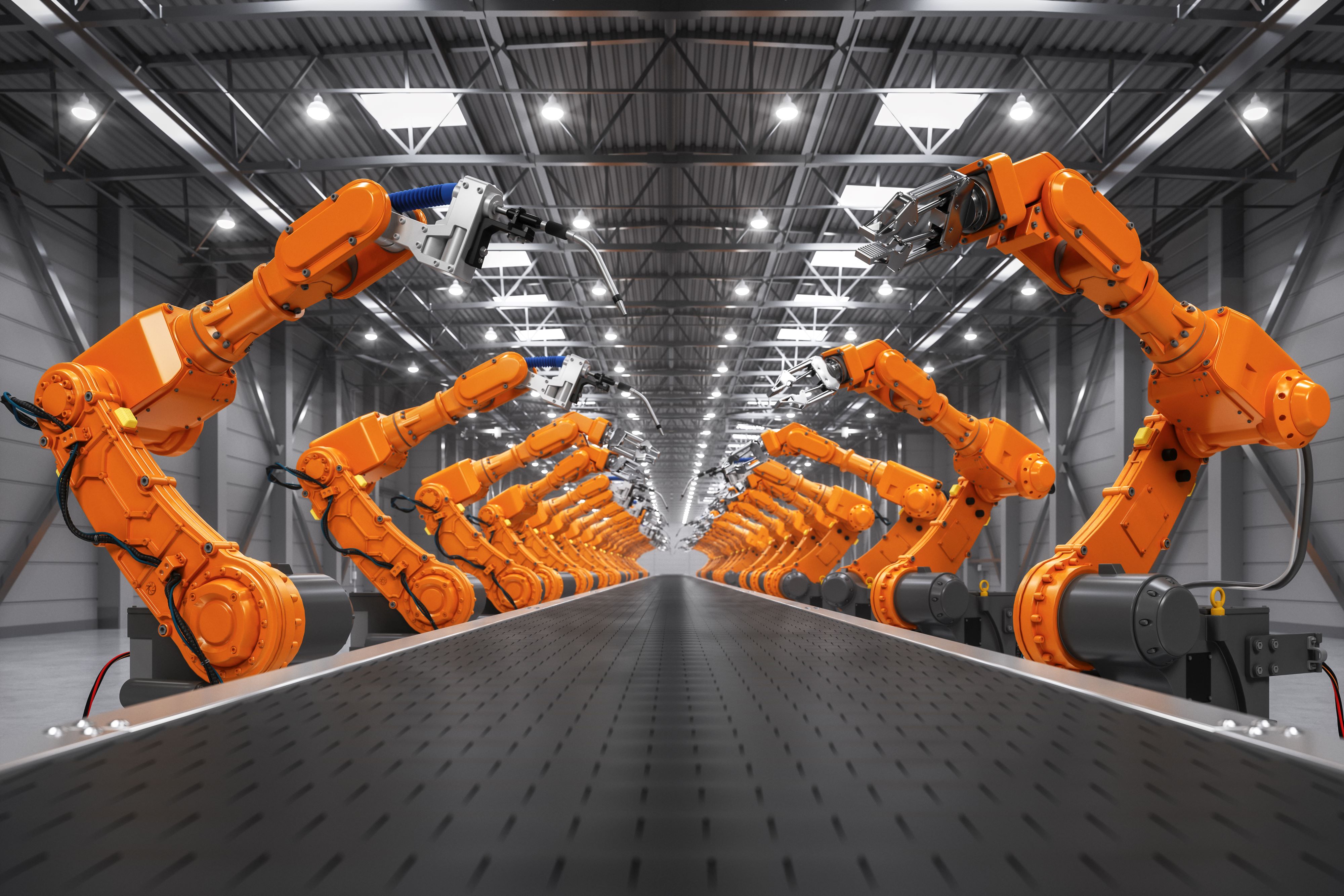

Since 1968, Milacron has been a global provider of highly engineered plastic processing solutions including injection molding and extrusion equipment as well as aftermarket parts and services. Milacron has long been recognized as a market leader for its product and service expertise serving a variety of end-markets, including the construction, automotive, packaging, consumer goods, and medical industries. With the largest installed base of equipment in the U.S., Milacron serves as a complete lifecycle partner, leveraging its extensive support network to deliver comprehensive aftermarket parts and services solutions.

“Milacron is an iconic American manufacturing business with a 50-year legacy of driving innovation in plastics,” said Matt Evans, a Partner at Bain Capital Special Situations. “With manufacturers increasingly focused on supply-chain resilience and domestic production, we believe the U.S. is entering a manufacturing renaissance that will create significant opportunities for industry leaders like Milacron. With its advanced engineering capabilities, global reach, and deep customer relationships, Milacron is well-positioned to build on its strong foundation.”

“We are excited to partner with Mac Jones, the President of Milacron, and the entire Milacron team to support the next chapter of growth of one of the world’s premier plastics processing solutions businesses,” added Chris Sun, a Principal at Bain Capital Special Situations. “Milacron combines industry-leading engineering and manufacturing capabilities with innovative technology to enable the production of essential products used daily in the U.S. and around the world. We share a common vision with Milacron’s associates, customers, and other partners to continue building on Milacron’s more than 50-year legacy to create an even stronger future ahead.”

“Following an in-depth portfolio review, we determined that Milacron would be best positioned for the future through this partnership with Bain Capital,” said Kim Ryan, Hillenbrand President & CEO. “Bain Capital has a proven track record of successful corporate partnerships and will provide greater resources to Milacron, which we believe will drive future growth and success for Milacron’s associates and customers, as well as for Hillenbrand’s shareholders.”

Bain Capital’s Special Situations team is making this investment following the successful close of its second vintage of funds, which raised over $9 billion. Bain Capital Special Situations has $22 billion in assets under management and has invested more than $16 billion since its inception in 2018, providing bespoke capital solutions to meet the diverse needs of companies, entrepreneurs, and asset owners. With a long track record of supporting industrial and manufacturing businesses globally, the team brings deep expertise in driving operational growth and long-term value creation.

The transaction is expected to close at the end of the Company’s fiscal second quarter or beginning of the fiscal third quarter. Deutsche Bank is serving as exclusive financial advisor, and Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal advisor to Bain Capital.

About Bain Capital

Founded in 1984, Bain Capital is one of the world’s leading private investment firms. We are committed to creating lasting impact for our investors, teams, businesses, and the communities in which we live. As a private partnership, we lead with conviction and a culture of collaboration, advantages that enable us to innovate investment approaches, unlock opportunities, and create exceptional outcomes. Our global platform invests across five focus areas: Private Equity, Growth & Venture, Capital Solutions, Credit & Capital Markets, and Real Assets. In these focus areas, we bring deep sector expertise and wide-ranging capabilities. We have 24 offices on four continents, more than 1,850 employees, and approximately $185 billion in assets under management. To learn more, visit www.baincapital.com. Follow @BainCapital on LinkedIn and X (Twitter).

About Hillenbrand

Hillenbrand (NYSE: HI) is a global industrial company that provides highly-engineered, mission-critical processing equipment and solutions to customers in over 100 countries around the world. Its portfolio is composed of leading industrial brands that serve large, attractive end markets, including durable plastics, food, and recycling. The Company pursues excellence, collaboration, and innovation to consistently shape solutions that best serve our associates, customers, communities, and other stakeholders.

Forward Looking Statements

This press release contains forward-looking statements, including statements that are within the meaning of the Private Securities Litigation Reform Act of 1995 that are intended to be covered by the safe harbor provided thereunder, which reflect the current views of Bain Capital and Hillenbrand regarding future events, expectations, plans, and prospects for Milacron following the announced transaction. These statements are based on assumptions and involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied in such statements.

Forward-looking statements include, but are not limited to, statements regarding: the expected benefits of the transaction; Milacron’s future growth, market position, and business strategy; anticipated industry trends, including implications with respect to growing supply chain resilience and domestic manufacturing; and the expected timing of the transaction closing.

Any number of factors, many of which are beyond Hillenbrand and Bain Capital’s control, could cause Hillenbrand and Bain Capital’s performance to differ significantly from what is described in the forward-looking statements. These factors include, but are not limited to: the ability to recognize the benefits of any acquisition or divestiture, including the Milacron injection molding and extrusion business sale (the “Proposed Transaction”), including potential synergies and cost savings or the failure of Hillenbrand and Bain Capital or any acquired company, or the Proposed Transaction, to achieve its plans and objectives generally; any failure by the parties to satisfy any conditions to the Proposed Transaction; the possibility that the Proposed Transaction is ultimately not consummated; potential adverse effects of the announcement or results of the Proposed Transaction on the market price of the Hillenbrand’s common stock; and risks related to diversion of management’s attention from Hillenbrand’s ongoing business operations due to the Proposed Transaction. There can be no assurances that the Proposed Transaction will be consummated.

Readers are urged to consider these risks and uncertainties in evaluating forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. For a more in-depth discussion of certain factors that could cause actual results to differ from those contained in forward-looking statements, see the discussions in Hillenbrand’s filings with the U.S. Securities and Exchange Commission.

The forward-looking information in this release speaks only as of the date on which it is made. Hillenbrand and Bain Capital undertake no obligation to publicly update or revise any forward-looking statement, whether written or oral, made to reflect new information, future developments or otherwise.