The Missing Emotional Layer in AI: Our Investment in Nuance Labs

We’ve all experienced the uncanny valley: the slight discomfort when watching an AI avatar speak, the sense that something fundamental is missing despite impressive technical capabilities. Today’s AI can reason brilliantly and generate human-like text, but when it comes to emotional intelligence, AI remains surprisingly tone-deaf.

That’s where Nuance Labs comes in. We at Lightspeed are excited to invest in their seed round alongside Accel as they build what we believe will become a foundational layer for emotional intelligence in AI.

As IQ becomes commoditized through increasingly capable language models, emotional quotient (EQ) emerges as the critical differentiator. Yet we believe current AI systems fundamentally miss this dimension. AI avatars feel robotic, not because of pixel quality, but because they lack the subtle emotional expressiveness that makes human faces compelling, and they are far from real-time responsiveness.

Nuance’s breakthrough insight mirrors that of large language models: just as LLMs learned to understand meaning by predicting the next word, AI can understand emotions by learning to predict human emotions and behavior.

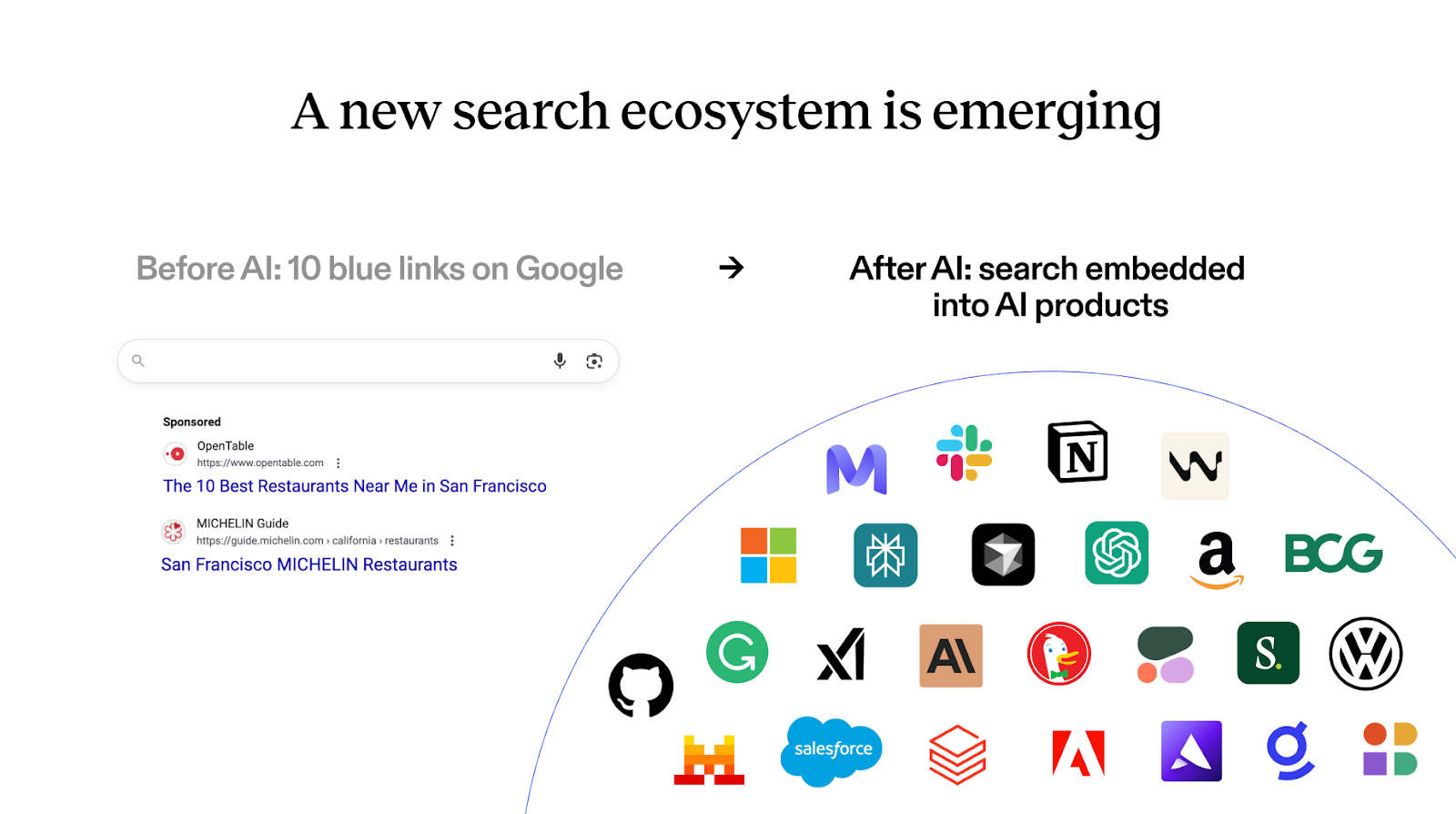

Nuance Labs is building a unified foundation model for real-time generation and understanding of realistic human expression across multiple simultaneous modalities, including text, speech, and video. This unlocks new categories of AI interaction:

- Real-time emotional generation: Lifelike avatars that don’t just speak words but convey appropriate emotional responses through coordinated facial expressions, vocal inflection, and body language. Imagine AI therapists that pause thoughtfully, offer encouraging expressions, and adapt their demeanor to your emotional state, all in real-time.

- Real-time emotion understanding: AI systems that can read subtle emotional cues as they happen, enabling applications like live coaching systems that detect when you’re losing confidence during a presentation, or interview AI that understands not just what candidates say but how they say it.

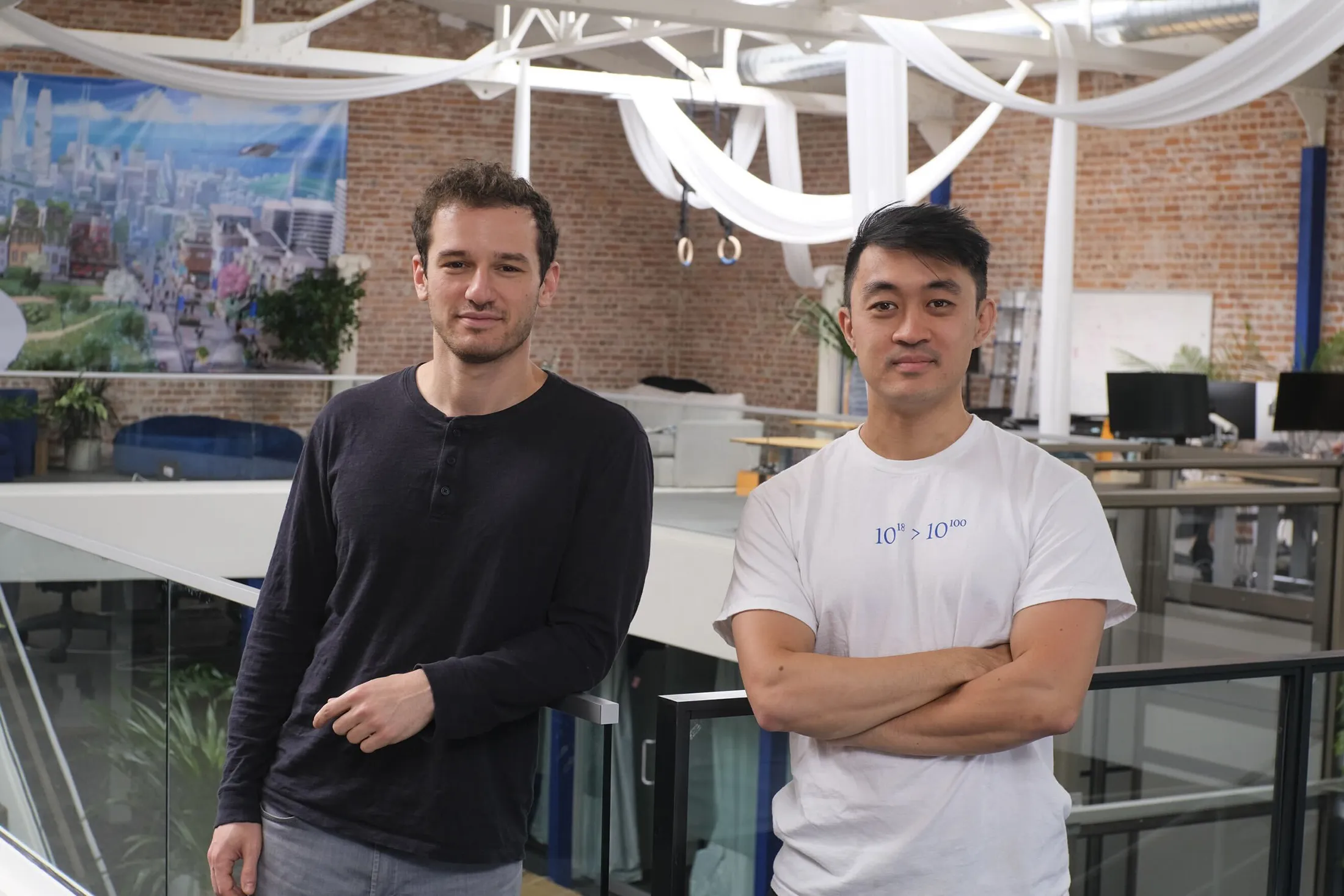

The team brings exceptional depth: Fangchang Ma and Edward Zhang previously built research teams at Apple, contributing to products like Vision Pro’s Digital Persona system. Their combined expertise in computer graphics, robotics, and machine learning, along with thousands of academic citations, strongly positions them to solve this technically complex challenge.

We’re entering an era where AI interactions will be measured not just by accuracy or speed, but by emotional authenticity. Any interface where humans interact with AI, from customer service and education to entertainment and healthcare, will benefit from emotional intelligence. We believe Nuance Labs is building the infrastructure that will power this next generation of AI experiences.

The uncanny valley stands as a barrier to natural human-AI interaction. Nuance Labs is building a bridge that will enable an entire ecosystem of emotionally intelligent AI applications. We’re thrilled to support their mission to make AI interactions as natural and emotionally rich as human conversation itself.

Excited to bring emotional intelligence to artificial intelligence? Nuance is hiring.

The content here should not be viewed as investment advice, nor does it constitute an offer to sell, or a solicitation of an offer to buy, any securities. Certain statements herein are the opinions and beliefs of Lightspeed; other market participants could take different views.

Authors